What is PointsYeah?

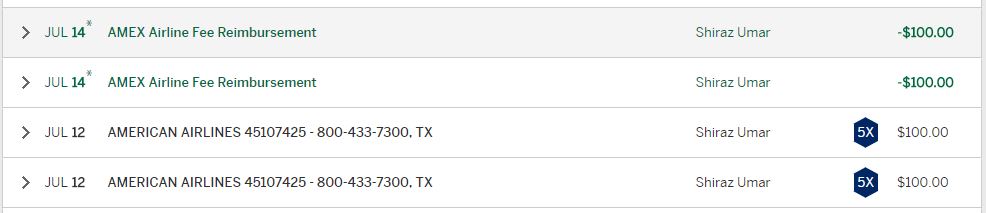

For those of you who have a stash of credit card points but are unsure how to utilize them, this post serves as an introduction to one of my favorite free tools for booking award travel. The website, PointsYeah.com, features a search function that allows you to find award tickets on various airlines, as well as a pathway for transferring them. If you hold a premium credit card that enables you to transfer points directly to airlines (Chase Sapphire Preferred or Reserve, Capital One Venture or Venture X, AMEX Platinum, Gold, or Green, to name a few), PointsYeah becomes even more valuable.

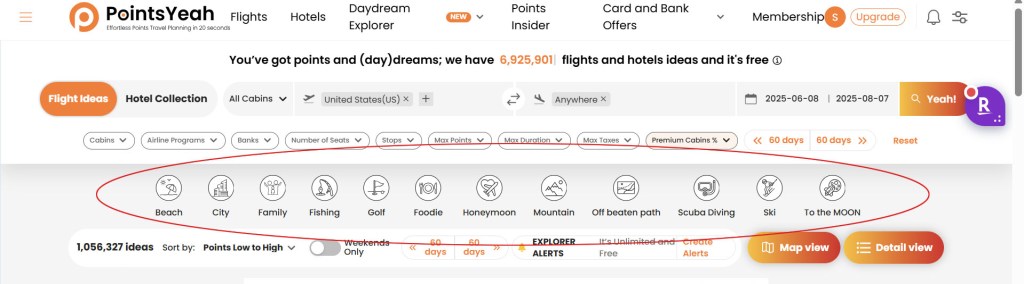

The search is easy to use and offers twenty different filters to narrow your search. If you have a specific date and location in mind, the process is straightforward: simply input the departure and arrival cities along with the planned travel date. If you have some flexibility, you can input a range of four days that you’re willing to travel (eight days if you pay for the premium membership). The search results will populate the cheapest redemption available on those days. You can also filter the search results to show only business class and first class award availability. If you’re looking for premium cabin redemptions on long-haul flights, I recommend being flexible with your departure date. You also set up email alerts, which will notify you when seats become available or when the price of an award booking drops.

What Makes PointsYeah Unique From Other Search Tools

The feature that really sets PointsYeah apart from other award booking search sites is the Day Dream Explorer function. You can use this function to broaden your search and see how far your points will take you. For example, if you’re open to traveling to any part of the world, input “anywhere” in the destination tab. This will populate a lengthy list of award redemptions from your departure city to cities worldwide. If you have multiple cities within a region on your bucket list, type your departure city and the area of interest (Europe, for example) in the search bar. The Day Dream Explorer function will provide the best redemption options for flights from your departure city to multiple destinations within Europe. Here is an example of a Day Dream Explorer Search from Chicago to Europe:

If you are interested in a particular type of destination (beach, mountains, golf, city, etc), the Day Dream Explorer Function can help you find award seats to those types of destinations as well.

You also have the option to broaden your search if you are willing to take a positioning flight (for example, flying from Chicago to Seattle to position yourself for a business class award redemption to Tokyo via Seattle). In that case, you can use Dream Explorer and input USA to Asia in the search bar. This will populate the best available award redemptions that pair two cities between the two continents. From my experience, if you input USA under departure and Europe as the arrival, the cheapest redemption options will mostly be from East Coast cities such as New York City, Boston, Washington D.C., Miami, and Atlanta as well as Midwest cities that are hubs to one or more of the legacy carriers (Chicago, Minneapolis, and Detroit). You may see Los Angeles and Seattle, but the number of flights and dates will be limited.

Alternatively, the best redemption options to Eastern Asia will mostly be from U.S. West Coast cities, such as Los Angeles, San Francisco, Seattle, and San Diego. You can filter your results by specific departure or arrival times, number of seats, non-stop flights, and more.

You can also search for award redemptions for major hotel programs such as Hilton, Hyatt, IHG, and Marriott. As a general rule, the only hotel program worth transferring points into is Hyatt, which can be done via Chase Ultimate Rewards or BILT. I do not recommend transferring Chase points to IHG or Marriott unless you are topping off your loyalty account to make a booking (you have 97,000 Hilton points and you need 100,000 points to get an extra night. It’s worth it in this scenario). AMEX also offers the option to transfer Membership Rewards points to hotel chains such as Choice, Hilton, and Marriott, and occasionally provides a transfer bonus to both. Even with the bonus, it’s usually not the best use of points if you are trying to extract maximum value. Although it may not be for everyone, I have found significant value on multiple occasions when transferring from American Express to Choice Hotels. If the ultimate goal is to conserve cash, and that is the priority above all else, then redeem the points for cash or a statement credit.