One of my friends asked me a pretty good question regarding Ultimate Rewards point transfers into partner programs: Which one should he avoid? While I’ve gone through many of the transfer partners that provide excellent value, I haven’t really addressed the transfer partners or scenarios that provide poor value and thus should be avoided. There are also certain situations where even a good frequent flyer program won’t provide good value if you transfer Ultimate Rewards points into the program. At the very least, you want to get a value of 1.25 cents per point if you’re using the Chase Sapphire Preferred (CSP) and 1.5 cents per point if you’re using the Chase Sapphire Reserve (CSR). How did I arrive at those numbers? If you book through Chase’s UR portal, that’s how much value you would get. For example, by booking a flight using the Chase Ultimate Rewards portal, a ticket worth $150 will require 10,000 UR points if you have the CSR. $150/10,000 = 1.5 cents per points. That same ticket would require 12,000 UR points if you have the CSP $150/12,000 = 1.25 cents per point. Here is what you should do to ensure you get the best value using your points: Make a comparison of the number of UR points required if you were to book through the Chase portal, the number of points required if you were to book through the hotel or frequent flyer program, and the dollar amount required if you were to pay with cash. For certain programs, the answer will be obvious and you will get a clear idea of what not to do. For others, there might be a tie and you won’t come out on the losing end either way. Let’s take a look at some transfer partners and see what type of value they might provide…

IHG

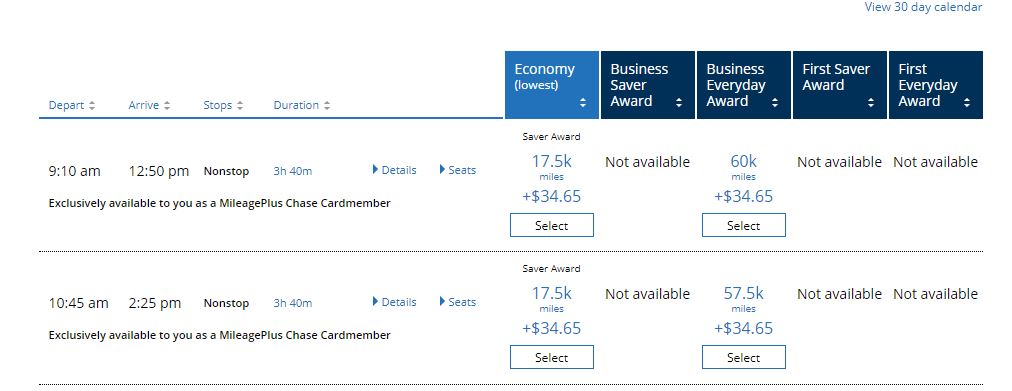

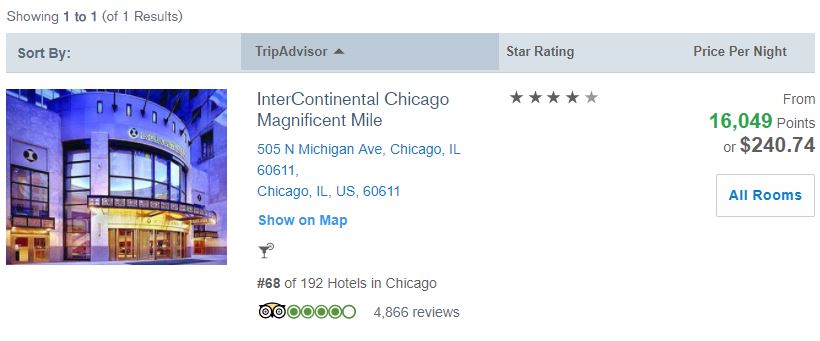

I’m going to use IHG hotels, the least valuable of all transfer partners in my opinion, as the first example. Ultimate Rewards points can be transferred into IHG on a 1:1 transfer ratio in increments of 1,000. Among the brands that are under the IHG umbrella are Holiday Inn, Intercontinental, Indigo, Kimpton, and Candlewood Suites. Let’s say you wanted to stay in Downtown Chicago between June 29th and July 1st at the Intercontinental Hotel on Michigan Avenue….

This would cost $233 a night. If you were to book as a CSR card holder straight through the Ultimate Rewards portal…..

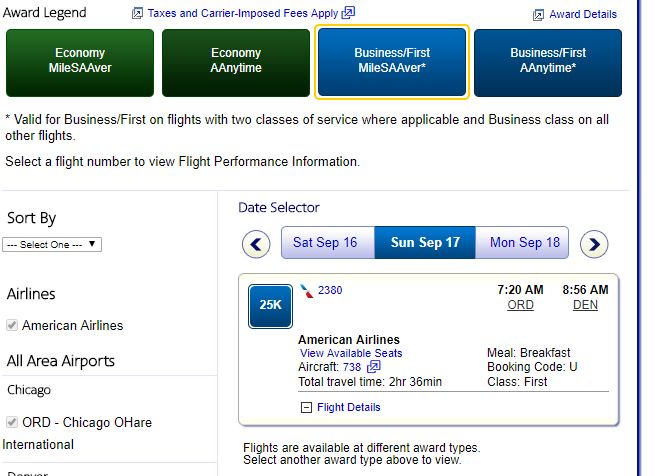

A good redemption of just over 16k points a night. This is a value of 1.5 cents per point and the litmus test you should use if you’re a CSR card holder booking through Chase. Last but not least, let’s see how many points you would have to transfer into IHG’s program from Chase if you were to use their loyalty program to book this hotel:

A ridiculous 50,000 points per night, meaning you’d have to transfer a total of 150k UR points for 3 nights. If you’re reading this, please don’t ever transfer 150,000 Ultimate Rewards points to make a booking like this in which you’re getting absolutely ripped off. If you do the math, $233/50,000 = 0.4 cents per point. You read that right. You’re getting less than a penny per point value if you transfer 150,000 UR points to book 3 nights at the Intercontinental Chicago on Michigan Avenue when the cash price is $233 per night. It’s unfortunate but these types of redemptions are the norm when using IHG points to book hotel stays. This particular redemption is so bad, you would be better off exchanging 69,900 UR points for $699 cash and then using the cash to book the 3 nights at the hotel. For this scenario, we would book straight through the Chase portal at just over 16k points per night. The only scenario you should consider transferring Ultimate Rewards points into IHG is if you need to top off your account and you’re just 5k or fewer points away from getting an award night at a higher redemption level. For example, if you’re at 29k IHG points and 30k would get you an award night, go ahead and transfer that 1k from Chase. The more you need to transfer, the more you’re losing value.

Marriott

Another transfer partner which provides terrible value when transferring points from Chase Ultimate Rewards is Marriott. Ultimate Rewards points can be transferred into Marriott on a 1:1 ratio in increments of 1,000. Don’t get me wrong, they have a very nice portfolio of properties which include upscale brands such J.W. Marriott and Ritz Carlton. But when you’re redeeming points, it’s all about getting maximum value and getting the most for your redemptions. Let’s say you wanted to stay in the Miami area from March 29th-March 31st in a location close to the airport:

The TownPlace Suites would cost $175/night or a ridiculous 50k Marriott points per night for a total of 150k points. This redemption is even worse than the one we saw above. Please do not, and I repeat do not transfer 150,000 UR points for this type of redemption. $175/50,000 = 0.35 cents per point redemption (lol). To put it into perspective, 60k UR points when transferred into United can get you a round-trip ticket to Europe. 60k UR points when transferred into FlyingBlue can get you two round-trip tickets to Hawaii. If you were to book straight from the Chase portal…..

A far more palatable redemption of nearly 12k per night, giving you the baseline value of 1.5 cents per point if you were a CSR credit card holder. If you carried the CSP instead, your redemption would require approximately 14,300 points per night for a value of 1.2 cents per point. In this scenario just like the one above, booking directly from the Chase Ultimate Rewards portal rather than transferring points into Marriott is the way to go.

Hyatt

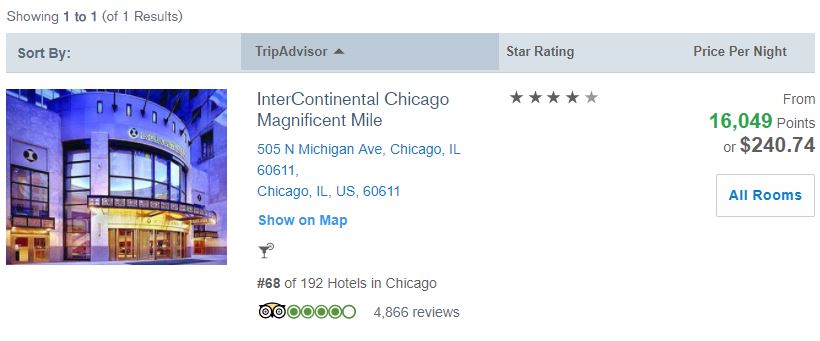

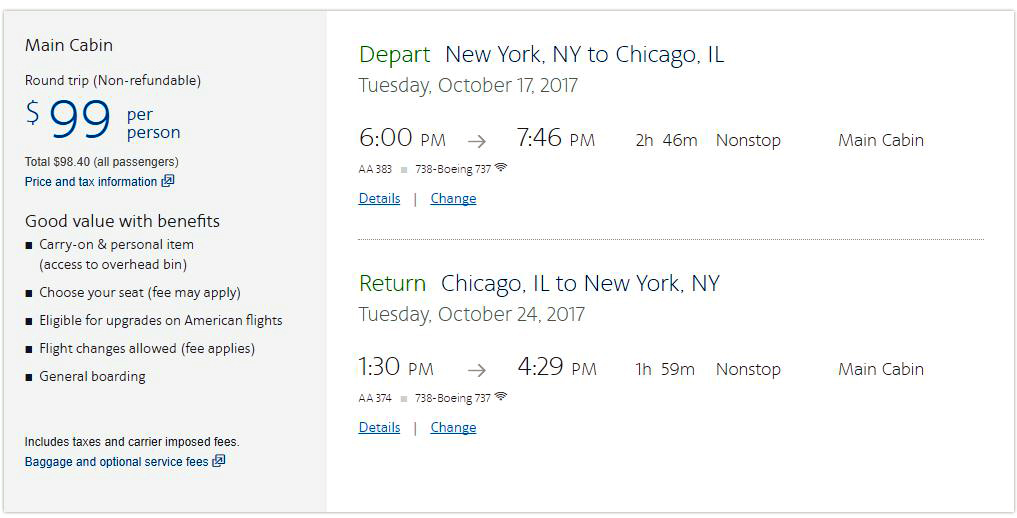

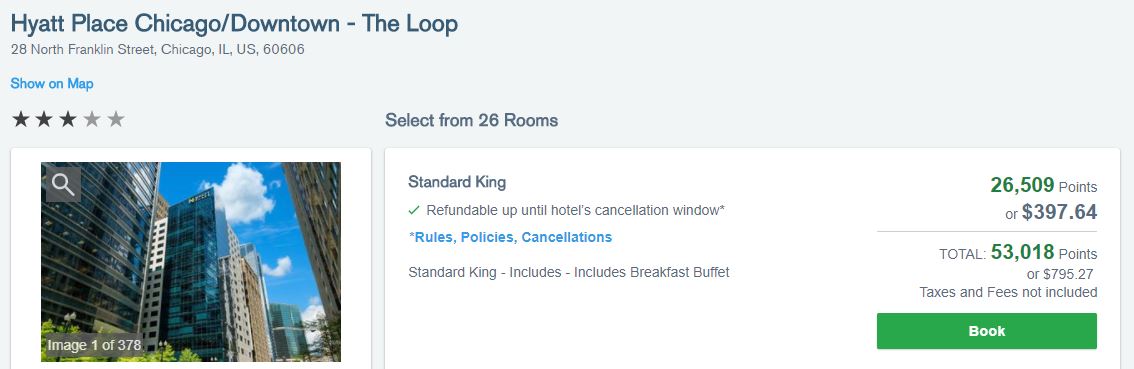

On the opposite end of the spectrum, I’m going to use Hyatt, one of my favorite transfer partners and one that provides excellent value as an example. Let’s say you wanted to make a booking at the Hyatt Place in Downtown Chicago between June 29th-July 1st. Here is the cash price you would have to pay per night: At the very minimum, $531 per night (!!).

If you were to book straight through the Chase Portal as a Chase Sapphire Reserve card holder:

At the very minimum, you’re spending 26,509 points per night. This gives you a redemption rate of 1.5 cents per point, the value you would get when booking through Chase as a CSR card holder. And finally, let’s see how many Hyatt Points would be required to make this booking…..

We have our clear winner. For 12k Hyatt points per night, you can find yourself in a room that would cost you $531 per night were you to pay with cash. If you do the math, $531/12,000 = 4.4 cents per point. This would qualify as a fantastic redemption and one where it would be a no-brainer to transfer your points from Chase UR into Hyatt. Prior to transferring into Hyatt, make yourself a World of Hyatt account on their website. This is free and you will get an account number which you will need to link with Chase in their Ultimate Rewards Transfer Portal. Below is just a simple schematic showing you where to go to transfer UR points.

When you click on your point balance, this will be the first page you see. Bring the cursor to “use points” and click on “transfer to travel partners”

Click on World Of Hyatt and transfer the total number of points you would need. Since Hyatt requires 12k points per night for our redemption and we searched for 3 nights, we would transfer a total of 36k UR points into Hyatt. The cash price for those 3 nights would have been nearly $1,600. The only downside of Hyatt is it’s relatively small footprint. They only have about 750 properties worldwide so finding a location where you can take advantage of this value can be challenging, particularly if you’re looking at international destinations.

Airline Transfers

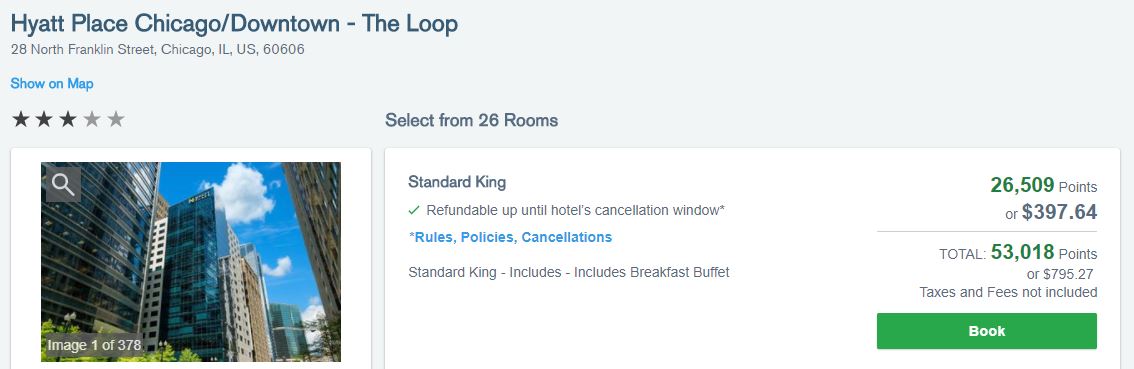

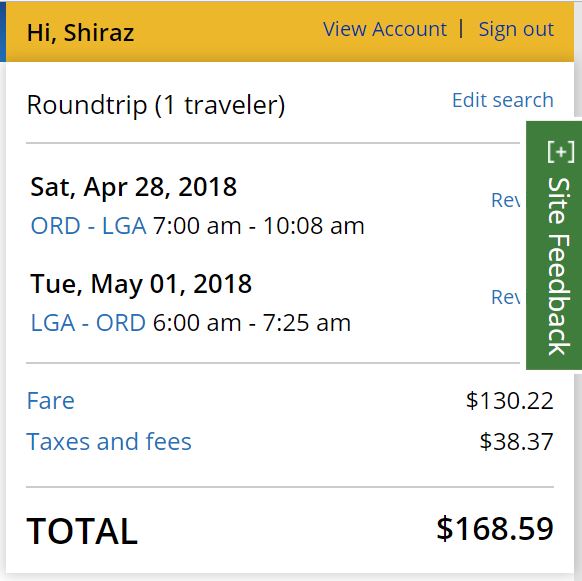

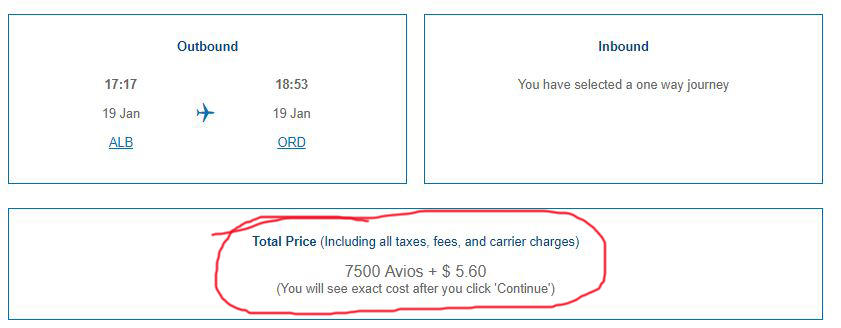

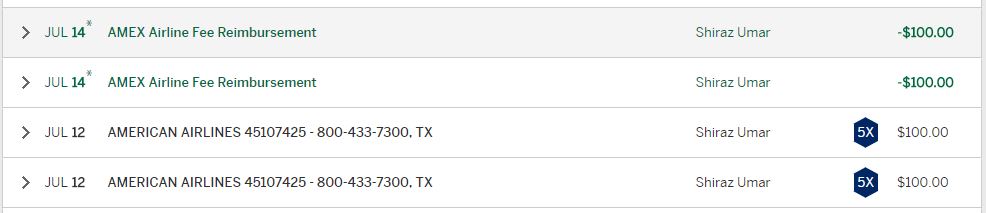

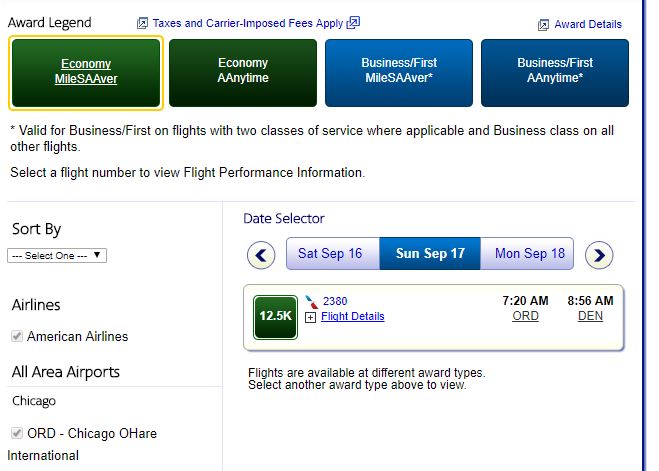

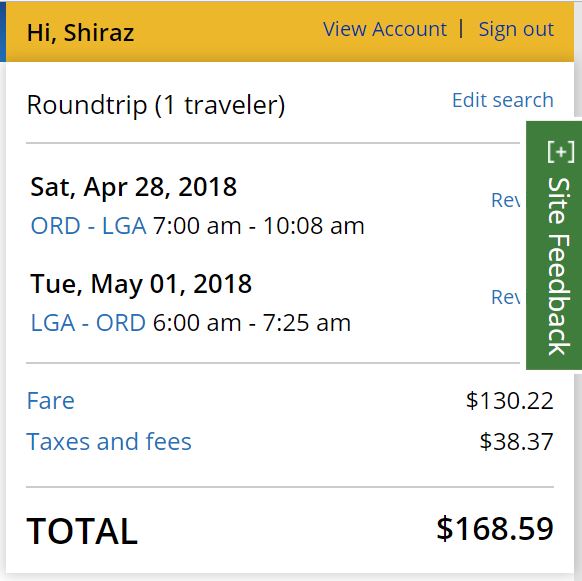

Generally speaking, transferring to the frequent flyer program of Chase’s airline partners provides very good to excellent value. A prime example of this would be transferring to British Airways Avios for domestic flights on American Airlines or transferring to FlyingBlue, the frequent flyer program of KLM/Air France for a round-trip ticket to Hawaii on Delta Airlines. However, there are certain situations where you’re better off booking a ticket by redeeming UR points through the Chase portal or using cash rather than transferring the points into a frequent flyer account to book a ticket. For this example, I’ll use a round-trip ticket from Chicago (ORD) to New York City (LGA) from April 28th-May 1st.

Pretty good price for a round-trip ticket between Chicago and NYC. Keep in mind, these are economy seats, not basic economy which can be had for $129 round-trip but with limitations such as no carry-on bags and no advanced seat assignments. Now if you wanted to use United miles for this trip…..

25k miles for a round-trip itinerary. How much value would you get if you transferred 25k UR points into United? $169/25,000 = 0.67 cents per point. This would be a terrible way to use UR points since you’re getting less than a cent worth of value per point. If you were to hold a Chase Sapphire Reserve and you booked through the Chase Ultimate Rewards portal, your redemption would require…..

Just 11,240 UR points for a round-trip ticket. You would save yourself nearly 14,000 points, or enough for possibly another round-trip ticket by using Chase’s portal versus transferring into United. If you had the Chase Sapphire Preferred, your redemption would be about 13,500 UR points, a significant number of UR points saved.

Recap

Prior to transferring into a program, evaluate whether you’re getting at least 1.5 cents per point if you’re a Chase Sapphire Reserve holder or 1.25 cents per point if you’re a Chase Sapphire Preferred holder. This is done by taking the cash price/the points required by the loyalty program.This should always be your litmus test prior to transferring. If you’re value matches or exceeds those numbers, transfer the points into the loyalty program. If not, then book directly through the Chase portal. The wildcard is if you happen to have status with a hotel chain. From my experience, hotels won’t extend status benefits if you don’t make the reservation through their own website or toll-free number. What what I do? I would still forego the benefits for IHG and Marriott if it means I’m going to get killed on the redemption when transferring UR points into either of those two brands. A free breakfast or room upgrade is not worth sacrificing a round-trip ticket to Europe, South America, or two round-trip tickets to Hawaii. If you want to read about the transfer partners that can provide tremendous value, you can read that here and here.