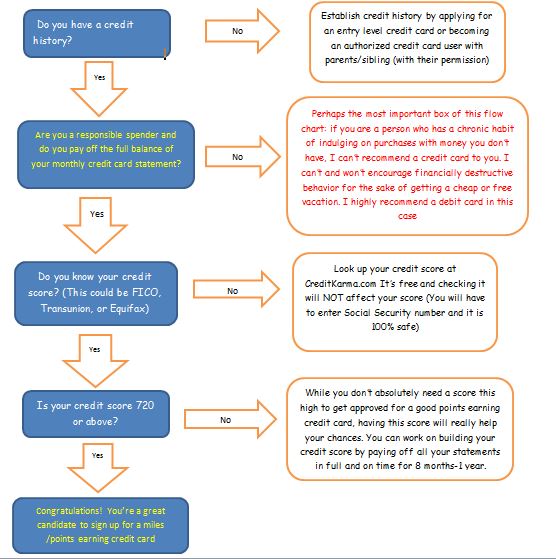

In this post, I’ll be focusing on how to unlock value with Chase credit cards. Let’s start with scenario 1: You just recently got the Chase Freedom and/or Chase Freedom Unlimited and you’ve hit the 15,000 point bonus after spending $500 over the course of the first 3 months. You’ve been accumulating points over several months and now you’re at 30,000 points. What do you do? Without having the Chase Sapphire Preferred or the Chase Sapphire Reserve, these are the options you have when you log on:

- Redeem for cashback. In this scenario, 1 point = 1 cent, so 30,000 points = $300.

- Redeem for a gift card. Just as the scenario above, 1 point = 1 cent, so 30,000 points = $300 gift card. You can mix and match the quantity and variety.

3. Redeem for travel: If you have 30,000 UR points, you can redeem that for $300 worth of travel. Just as the previous two scenarios, you will be getting 1 cent per point. Now, let’s say you would rather use those points towards a vacation and want to book a trip to Maui, Hawaii (Kahului Airport) from New York City (JFK). When you search for the trip on Chase, this is what you would get:

Since you have 30,000 points, you can apply those points towards this flight and receive $300 in credit. However, you would still be on the hook for $463.60 in cash. It is better than nothing, but if you have the Chase Sapphire Preferred or Chase Sapphire Reserve, those points will go a lot further. Scroll down to see what I mean….

Booking with Chase Sapphire Preferred or Chase Sapphire Reserve

Here is the alternate scenario. Suppose in this case you have the Chase Freedom and/or Chase Freedom Unlimited just like above. Unlike the scenario above, now you have it paired with the Chase Sapphire Preferred. You got your Chase Sapphire Preferred and you received your 50,000 point bonus after spending $4,000 over 3 months. You already have 10,000 points on your Chase Freedom from previous spending. What do you do next?

Go to the Chase Freedom Ultimate Rewards home page and direct the cursor of the mouse over your point total (10,000 points in this case) without clicking. When the drop tab opens, scroll down where you see “Combine Points”and click. This will bring you to the following page……

Since we want to move from Freedom to Sapphire Preferred, we click on those two and click submit. Now we have a total of 60,000 points in the Chase Sapphire Preferred. Next, go to the Chase Sapphire Preferred Ultimate Rewards home page. ….

Move the mouse cursor over “Use Points” and the drop down tab will give multiple options on how you want to use them. We now see an option that we did not see for the Chase Freedom and Freedom Unlimited: the ability to transfer to travel partners. Go ahead and click on this option. This is the step which allows you to unlock a ton of value. When you click, you will see multiple airline and hotel programs, which you can transfer your Ultimate Rewards points into on a 1:1 ratio.

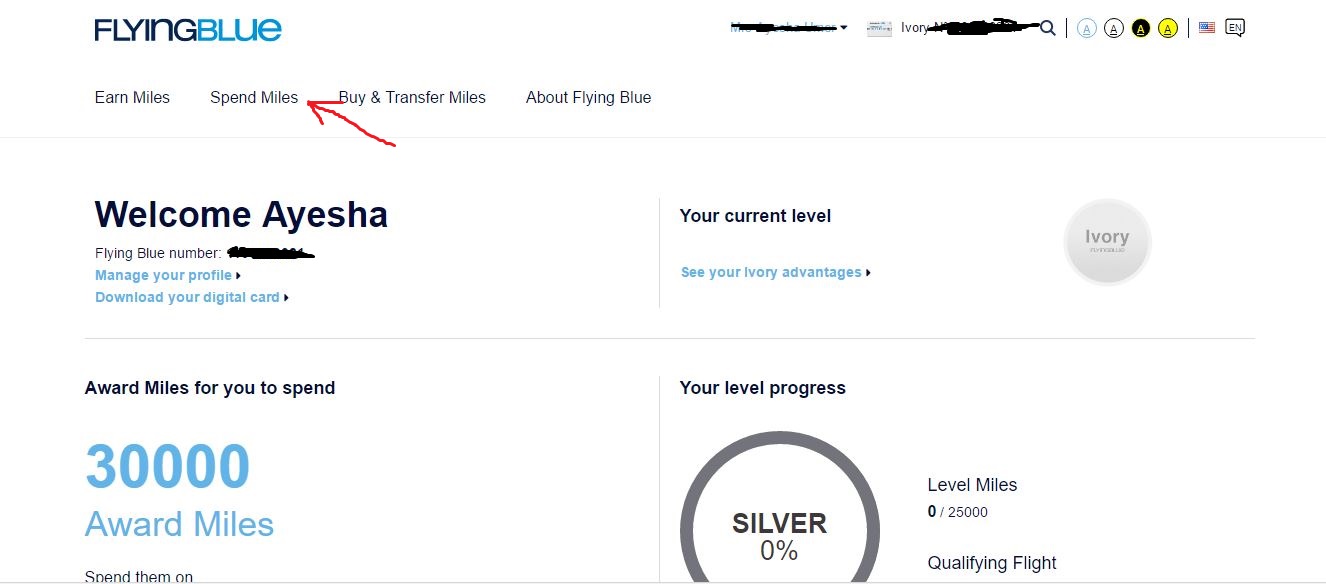

Before you transfer your points into one of these programs, you will have to make an account with them. It is free and it is something you should probably do immediately after getting the Chase Sapphire Preferred or Reserve. Just keep in mind, transfers are 1 way only! Once you transfer into a program, they CANNOT be transferred back into Chase. Always check to make sure that there are award flights available in your desired seating class (economy, first class, business class) on your travel dates BEFORE transferring your points from Chase to any airline or hotel program. Sometimes certain dates will show business class availability (usually double or triple the amount of miles needed for economy) but not economy class or vice versa. Now, let’s say you still want to book this trip to Maui from NYC as from the example above. We will pick Flying Blue (Air France/KLM) as our transfer partner ( I’m going to use my wife’s account as an example since she has Flying Blue Points in her account).

When you arrive at the home page and log in, the page above is what you will see. Click on spend miles and this will lead to you to the page below….

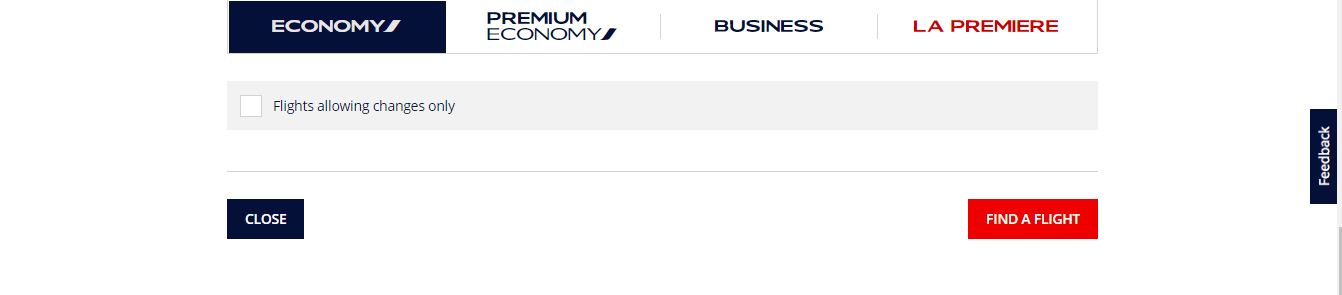

Click on book your award ticket. This will take you to the page below ….

.

I inquired for 2 passengers from New York City (JFK) to Maui (Kahului). I entered May 2nd-May 9th, 2017. If you check the box that says “you are looking for a flight around these dates” it will open up a calendar to show availability on different dates of the month…

As you can see, there is plenty of flight availability from New York City (JFK) to Maui (Kahului) for only 15,000 miles a person one way. While KLM and Air France do not fly to Hawaii from JFK in New York City, Delta does. Delta is part of the Sky Team Alliance with KLM , Air France, and Korean Airlines, among others. When you search up award tickets on FlyingBlue.com, Delta flights will appear for this particular itinerary. As we look at the calendar, our desired date, May 2nd happens to be available. When you click on any of the dates, it will then take you to a calendar that shows availability for your flight back…….

And luckily for us, there is award availability not only on the 9th, but also on the 10th and 11th of May for our trip back. Again, only 15,000 miles a person. So we’ll click on May 9th as we decided earlier….

60,000 miles and about $12 on Delta is the total cost in miles for you and one other person to go from NYC to Maui and back (30,000 miles round trip per person). The next step is to pick your flight. As with most people, I choose the one with the shortest total flight time, even it means waking up early. You’re going to Hawaii! Don’t waste extra time in an airport somewhere because you don’t want to wake up at 5 am to take the earlier flight…..

This would be the shortest itinerary going to Maui with the flight departing at 9:30 am and having a 2h 35 min layover in Los Angeles. This isn’t a terrible length for a layover and maybe you’ll see a celebrity or two. LAX does have some great dining options if you’re hungry. You depart LA at 3:35 pm local time and you still end up in Maui by 6:40 pm local time , jet lagged but in time for dinner.

And here is your flight back to New York City. Shorter layover, and shorter flight time. Now if you’ve been keeping along, 30,000 Ultimate Rewards points only got you $300 worth of value when you did not have the Chase Sapphire Preferred or Reserve. For this scenario, 30,000 Ultimate Rewards points is getting you one round trip ticket to a magical place like Hawaii. Just for the sake of comparison, let’s go to Kayak.com and see what this same trip would cost if we were to pay in cash…

If paid in cash, this trip would cost you $700 a ticket (cheapest ticket). This itinerary is not only longer, it requires you to have 2 connections, both going to Maui and coming back to NYC. This is what I mean when I say unlocking value. By having the Chase Sapphire Preferred or Reserve, you are able to turn 60,000 Ultimate Rewards points and get $1,400 worth of value. Without them, all you can do is get $600 worth of value. This is a great example of why I tell people it is worth paying the $95 annual fee on the Chase Sapphire Preferred (and the more expensive $450 annual fee on the Reserve if you take advantage of its benefits.) In this instance, the annual fee just paid for itself 8 times over by booking a trip which cost you only 60,000 miles vs $1,400 had you paid in cash. Now you have money left over that could be put to use for better accommodations, more activities, rental car upgrade, visiting another island (Kauai or Oahu?) and using it on things you might actually enjoy, rather than paying $1,400 cash for you and someone else to sit on an economy seat for 12 hours. Remember, the annual fee is waived the first year on the Chase Sapphire Preferred as it is. If you find yourself not taking advantage of the benefits, you can always downgrade the card or cancel it after 11 months. I hope this helps everyone. Thanks for taking the time to read.

– Shiraz