The Chase MileagePlus Explorer card is a card I have kept for six years running. Initially, I kept the card mainly to avoid the checked bag fee, especially as our family continued to grow with little ones, and checking in bags became unavoidable. Some benefits have remained in place, such as two United Lounge passes that Chase gives yearly upon renewing the card and priority boarding. These perks have further appeal in the realm of basic economy, and having an airline credit card assures you of being allowed to carry a bag that can be checked in or carried on (if you book a basic economy fare). What happens if you don’t have an airline-branded credit card and book the basic economy fare? You can only bring a bag that can fit under your seat. Anything that goes into the overhead bins would have to be paid for, and airlines are starting to enforce this policy at the gate.

Many airline credit cards are popular for churning. This means you sign up and get approved for the card, rack up the bonus miles after hitting the minimum spend threshold, and cancel the card within a year. Then you can apply those miles to that destination you’ve been saving up for. Since I find myself traveling between Chicago and the East Coast several times a year, I’ve held on to the United MileagePlus Explorer card as well as the Citi American AAdvantage Platinum to save on baggage fees and for the convenience of priority boarding (on super busy routes such as LGA to ORD, it assures overhead bin space). If there was only one credit card you wanted to pay an annual fee for, I wouldn’t recommend an airline-branded card since you’re married to that one airline if you want to reap the benefits. A credit card such as the Chase Sapphire Preferred or Reserve would be the better option since you have multiple airlines whose frequent flier programs you can utilize via transfer. But if you’re willing to pay for two cards and you live near a United hub (Chicago, D.C., Houston, Denver, San Francisco, Newark/NYC, and Los Angeles), the United MileagePlus Explorer credit card might be one of the most appealing airline-branded credit cards available. In addition to the benefits I outlined above, United offers exclusive mileage redemptions to card members only.

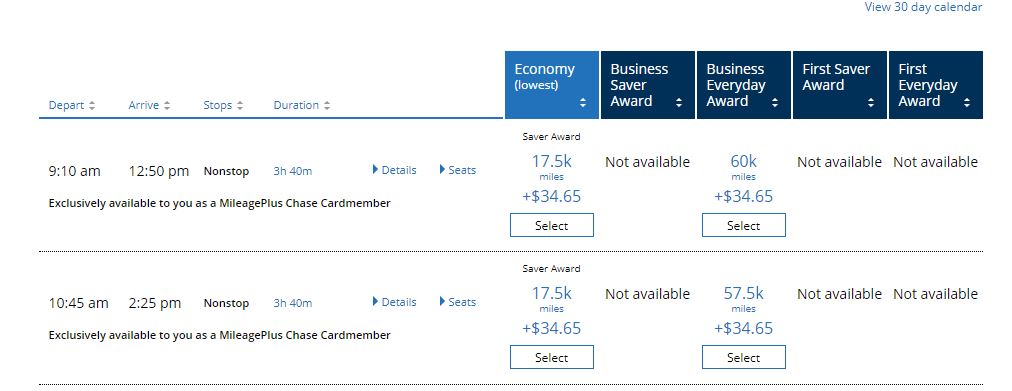

I used an example itinerary from Chicago (ORD) to Cancun from July 29th to August 4th. In both instances, we’re going to use award redemptions. The first example is the redemption available to Chase United MileagePlus credit card holders.

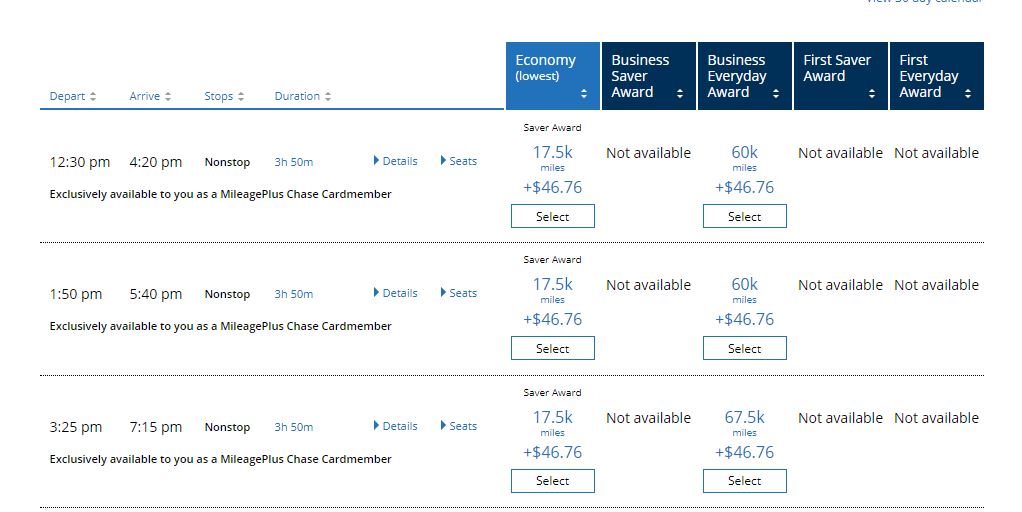

Now let’s look at redemption availability if you want to book this same trip using United Miles, but don’t hold the United MileagePlus Explorer credit card:

As you can see in the example above, having the Chase MileagePlus Explorer card means you’re using only 35k miles (plus the applicable taxes) with the benefit of having a non-stop flight on both legs of the journey. Without it, you’re using, at a minimum, 42.5k miles, and likely 50k miles if you want to have a non-stop each way and a productive first day in Cancun. How much is that 15k miles savings worth? The Points Guy values each United mile at 1.5 cents. 1.5 x 15k = $225. This is just an estimate, but even if you value it a bit lower, it becomes obvious that the miles you saved by having the card are worth far more than the annual fee of $95 you’d be paying to keep the card. Again, this card isn’t for everyone; travelers who live near a United hub would benefit the most. If you are a Chase Sapphire Preferred/Chase Sapphire Reserve cardholder and find yourself transferring Ultimate Rewards points into United often, pairing the MileagePlus Explorer card with either of them only enhances their value.

Photo source: http://www.chase.com